Investors may encounter advantages and difficulties due to the unpredictable nature of financial markets. One strategy that traders often employ in such markets is the Long Strangle strategy. This approach allows traders to profit from significant price swings without predicting the underlying asset’s direction. This article will explore tips and considerations for implementing the Long Strangle strategy in volatile markets.

Understanding The Long Strangle Strategy

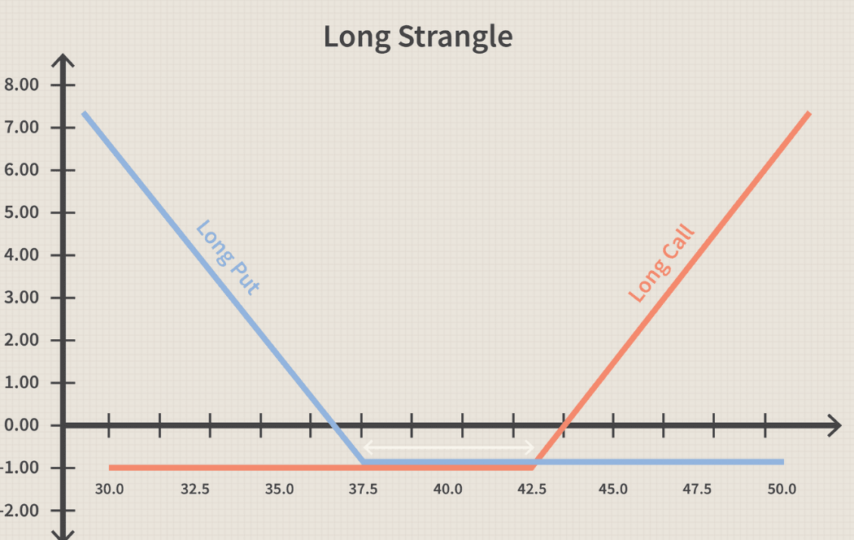

The Long Strangle strategy entails the purchase of a call option and a put option that share the same expiration date but have varying strike prices. This strategy aims to benefit from a significant move in the underlying asset’s price, regardless of whether it moves up or down. Holding both calls and put options simultaneously allows traders to take advantage of increased volatility.

Selecting The Right Assets

When implementing the Long Strangle strategy, selecting assets known for their volatility is crucial. Look for stocks, indices, or commodities with a history of large price swings or are expected to experience significant market-moving events, such as earnings announcements or economic reports.

Consider The Implied Volatility

Implied volatility plays a crucial role in the pricing of options. As a Long Strangle strategy trader, you should pay attention to the implied volatility levels of the options you are considering. Higher implied volatility generally leads to higher option premiums, which can increase the cost of implementing the strategy. Consider entering the trade when implied volatility is relatively low, as it provides a more favorable pricing environment.

Setting Strike Prices And Expiration

Selecting appropriate strike prices and expiration dates is critical to the Long Strangle strategy. The strike prices should be set far enough from the current price to allow for significant price movements. This ensures that both the call and put options have the potential to become profitable.

Choosing an expiration date that allows enough time for the anticipated price move is advisable. Avoid selecting expiration dates too close to the present, as it may not allow the trade to play out.

Risk Management

Managing risk is paramount when implementing any options strategy. In the Long Strangle strategy, the risk is limited to the cost of the options. Traders should be aware that if the underlying asset’s price remains within a narrow range until expiration, both options may expire worthless, resulting in a loss. Therefore, allocating an appropriate amount of capital is crucial and does not risk more than one can afford to lose.

Monitoring And Adjusting The Trade

Once the Long Strangle strategy is implemented, it is essential to actively monitor the trade and be prepared to make adjustments if necessary. Suppose the price of the underlying asset starts moving significantly in one direction. In that case, it may be beneficial to close out the unprofitable option to limit potential losses or secure profits on the profitable leg of the trade. Regularly reassess the market conditions and adjust the trade to optimize potential gains and manage risk.

Conclusion

Implementing the Long Strangle strategy in volatile markets can offer traders opportunities to profit from significant price movements without having to predict the underlying asset’s direction. By selecting the right assets, considering implied volatility, setting appropriate strike prices and expiration dates, and practicing effective risk management, traders can increase their chances of success. However, it is essential to remember that options trading involves risks, and thorough research and understanding of the strategy are vital before committing any capital. It is advisable to seek guidance from a financial expert before making investment choices.