The Schedule 1 Form 2290 is a crucial document for those who operate heavy vehicles on American highways. This form is used to report and pay Heavy Vehicle Use Tax (HVUT). If a vehicle carries 55,000 pounds or more of cargo, this tax must be paid. HVUT is introduced to maintain and improve the highway infrastructure of the country. To ensure compliance and avoid penalties, it’s essential to understand the filing requirements for the Schedule 1 – 2290 form.

What is Schedule 1 Form 2290?

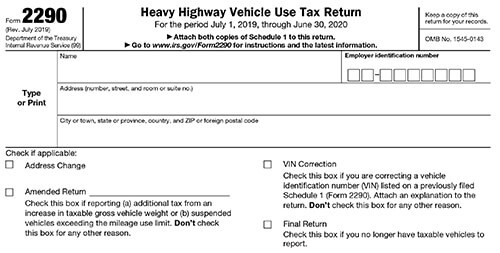

schedule 1 form 2290 is an integral part of the overall Form 2290. It is the heavy highway vehicle usage tax returns that contribute significantly to the development of the state. This form is filed annually with the Internal Revenue Service (IRS). It applies to any person or business operating heavy vehicles on public highways. The information provided on Form 2290 and its associated Schedule 1 is used to calculate and pay the HVUT.

Filling Requirements: Schedule 1 Form 2290

Vehicle Information

The first step in filling out Schedule 1 Form 2290 is to provide accurate and detailed information about the heavy vehicle. Home Vehicle Identification Number (VIN), the total taxable weight of the vehicle is verified. Also, it is checked whether the vehicle was specifically used for logging. It is important to ensure that this information is correct. Because errors can come under delay or penalty.

Taxable Period

HVUT is usually assessed for 12 months. It begins on 1st July and ends on 30th June of the following year. Schedule 1 should begin during the tax period when Form 2290 is completed. But while filling the form you have to mention the last months for which you are paying tax.

Filing Method

The IRS allows for both paper filing and electronic filing (e-filing) of Form 2290. While paper filing involves physically mailing the completed form to the IRS, e-filing can be done online through authorized e-file providers. E-filing is generally faster, and more convenient, and often results in quicker processing and receipt of Schedule 1.

Proof of Payment – Schedule 1

Once Form 2290 is submitted and the HVUT is paid, the IRS will issue a stamped Schedule 1 as proof of payment. The Form 2290 document is important for several reasons. It serves as proof that HVUT has been provided. Also, documents required for certain transactions must be maintained. Such as – registering a heavy vehicle with the Department of Motor Vehicles (DMV).

Additional Requirements for E-Filing

There are many things to be followed while doing e-filing. You must provide your Employer Identification Number (EIN). Also, your EIN must be on record with the IRS. Additionally, you need to make sure that you provide all the correct information that is consistent on file with the IRS.

Correcting Errors

If you make a mistake on Schedule 1 Form 2290, such as an incorrect VIN or taxable weight, it’s important to correct it as soon as possible. The IRS guides how to correct errors on a filed Form 2290, which may involve filing an amended return.

Penalties for Non-Compliance

Failure to comply with the HVUT filing requirements can result in penalties. These penalties can accrue over time, leading to significant financial consequences. Penalties can include a percentage of the HVUT owed, interest on the unpaid tax, and potentially even the suspension of your vehicle’s registration.

Final words

Understanding the filling requirements for Schedule 1 Form 2290 is essential for anyone operating heavy vehicles subject to the Heavy Vehicle Use Tax. Accurate and timely filing ensures compliance with IRS regulations and helps maintain the integrity of the highway infrastructure. Whether you choose to paper file or e-file, make sure to provide accurate vehicle information, pay the appropriate HVUT amount, and obtain the stamped Schedule 1 as proof of payment. This not only helps you avoid penalties but also contributes to the upkeep of the nation’s vital roadways.