Digital finance will expand consumers’ purchasing power outside the financial services sphere. Global financial infrastructure is changing because of digital platforms. Various stakeholders are leveraging the smartphone with various financial agents to offer simpler and stronger financial mobile app development services at appropriateness and reduced cost toward traditional finance.

Digital payments adoption is outpacing Cash at retail locations and representing 60% of internet business exchanges in the locale. Furthermore, regardless of this market entrance, there’s no symbol that it is the space that is easing back down truth be told, capital put resources into the installments innovation area hit another record in 2020, and all the best-supported new companies are moreover Playtech kinds or dynamic in the installments area. Entrepreneurs in the mobile banking market have to vigorously acquire clients so that they can gain market share due to the high competition in the market. Loyalty is indispensable to grow, but while the purchase is necessary for growth, we are now seeing brands of loyalty never stay for so long. So to contextualize challenges and potential opportunities, let’s examine the APAC digital payments sphere.

Where things are now concerning digital payments in the APAC

FinTech firms in the Asia-Pacific region have seen a huge surge in customer base. Installations for finance apps in APAC decreased 18 percent year over year (YoY) but campaigns driven by non-organic tactics increased to 65 percent. The net result is that more marketing dollars are being poured into trying to get individuals’ attention. Such actions waste valuable time and money.

Acquisition charges are also raised by cheap financing, often due to expense scratches or other promotional strategies. While these incentives may be necessary for starting usage habits, over-reliance of these inducements could give to a weakening of consumers using the product if occupational produces no longer being sustainable. This means that this service is not complete unless people increase the usage time or purchase greater products.

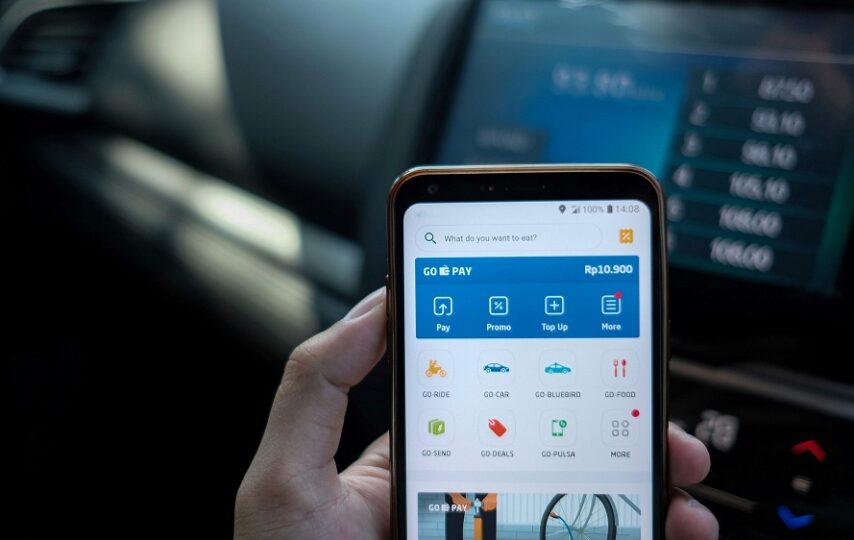

The answer is.. Most effective APAC digital files nowadays generally contain one function such as ride-sharing, chat, or an activity that keeps the consumers using. These “Amazing apps” often employ multiple partnerships in order to Fulfill as numerous daily behaviors as you can, from shipping providers and online markets to service charge installments and even credit scoring for monetary administrations. Rivaling these exceptionally captivating, multifaceted stages can be a test for more modest brands, but it is also potential to learn a significant lesson in their case –especially, the significance of encouraging continuing engagement so as to induce more powerful retention and long-term value.

How can FinTech Brands in APAC Succeed in Challenging Landscape?

An effective method to raise your business is to promote it as rapidly as possible using heavy marketing expenditure. To deal with this challenge, you must build an ecosystem where customers is towards the core of your strategic plan and you must develop a way to invite or encourage fresh users hooked on your world.

What does this mean in practice? You should be located where your customers are, in their “everyday lives”. Think carefully about the moments when you’re able to deliver your message and creatively emphasize on them. By targeting audiences on their real behavior and preferences, modern technology makes your messages more efficient and stops one-size-fitting messaging.

This fallacy is to not attempt to keep your users forever. Ordering actual retaining marketing approaches upfront allows you to hold more users to retain in the long run. The ideal position for success is to pay attention to customer needs.

Applying the Acquisition Loop Strategy for Customer Involvement:

If you only get new clients thru compensation marketing techniques, the size of your growth will be limited by the sum of your budget. In the highly competitive APAC payments industry, smaller, less-funded companies can fall prey to the larger, best companies. While paid purchase will continue to play a role, it isn’t the only method to raise your client base.

With the procurement loop method, your advertising isn’t a holding pipe, nonetheless somewhat a piece of the overall funnel where people are encouraged to spread the word for you about your product. The acquisitions loop could determine sustainability and competence by safeguarding that company’s advertising budget doesn’t increase at the same rate as its business targets. These performance loops are typically hard to copy by rivals brands, since they are incorporated in your product understanding in a significant way, while personal organizations and techniques may well be duplicated by rivals, decreasing their impact.

Final Thoughts

It is indeed important to do appropriate planning and analysis for acquiring loops as well as continuing engagement marketing programs. FinTech companies should be focusing on delivering experiences to customers so they could be different in an overexposed industry.