Enter the world of available business funding alternatives now! Today, we’re exploring the fascinating world of Merchant cash advance blursoft. Knowing the details of Merchant cash advance blur soft may completely change your financial plan, whether you’re an established company owner or just starting out. Are you prepared to go off on this interactive exploration? Together, we’ll explore the secrets surrounding Merchant cash advance blursoft, examining their distinctive features, benefits, and key factors. Get ready for a fascinating investigation of an innovative financing choice that may help you overcome financial challenges and ignite the potential for business development. Let’s dive in and discover the mystifying fascination of Merchant cash advance blursoft review!

Accelerate Your Business with Merchant Cash Advance Blursoft!

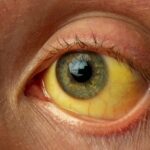

Image credit – finance team

A merchant cash advance blursoft is a type of financing option in which a business receives a lump sum of money in exchange for a percentage of its future credit card sales or revenue. Unlike traditional loans, merchant cash advances are not based on credit scores or collateral but are instead determined by the business’s average monthly sales volume. The repayment is typically done through an automated process, where a fixed percentage of daily sales is deducted until the advance is paid off, often with an additional fee. While merchant cash advances can provide quick access to capital for businesses with fluctuating revenue, they tend to carry higher costs compared to traditional loans, making it important for businesses to carefully evaluate the terms and consider the potential impact on their cash flow.

How to Get Quick Cash from Merchant Cash Advance Blursoft?

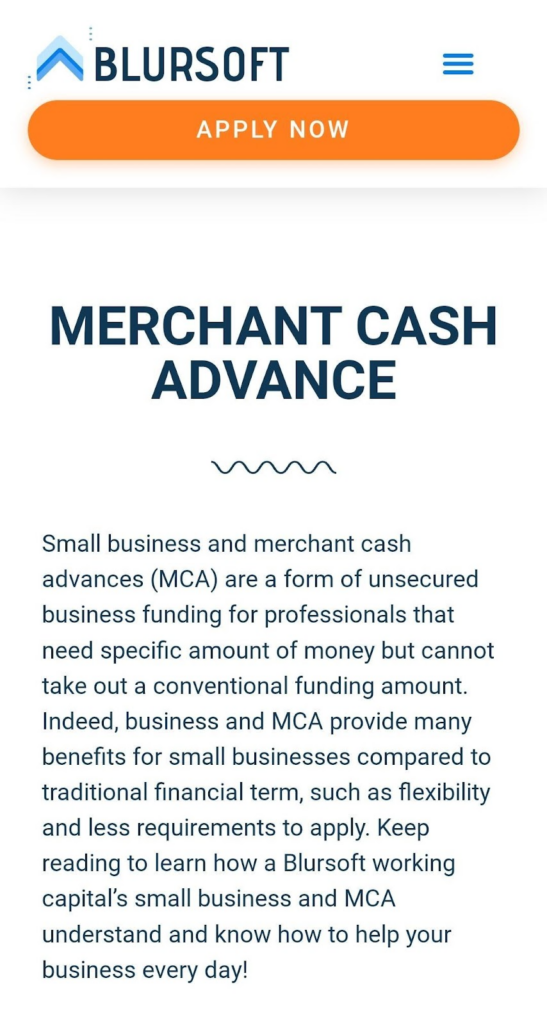

Image credit – blursoft

To get cash using a Merchant cash advance blursoft, do the following:

1. Investigate and contrast your options: Start by looking at several Merchant cash advance blursoft providers to choose the one that most closely matches your requirements.

2. Determine eligibility: Each source of Merchant cash advance blursoft has particular eligibility requirements. Typically, they search for companies with a minimum monthly income or sales requirement for credit cards.

3. Prepare your financial documents: Gather the essential financial records to demonstrate your company’s sales volume, such as bank accounts, credit card processing statements, and tax filings.

4. Submit an application: Fill out the Merchant cash advance blursoft application by sending your supplier of choice the necessary paperwork.

5. Examine the terms: After receiving an offer from the supplier, thoroughly read and comprehend the terms and conditions, including information on the repayment plan, holdbacks, and related costs.

6. Accept the offer: If you are OK with the conditions, sign the contract or give the supplier your electronic approval as instructed.

7. Receive the funds: After you Accept the offer, the supplier will normally send the cash right into your company’s bank account.

8. Repay the advance: Repayment is often automatic, with a portion of your daily credit card sales or income removed to pay back the advance and any associated costs.

What are the Eligibility criteria of Merchant Cash Advance Blursoft?

The criteria for requesting a Merchant cash advance blursoft might vary from provider to provider. However, the following are some typical standards:

1. Minimum Monthly sales: In order for a company to be eligible for a loan, most providers have a minimum monthly sales requirement.

2. firm Age: A minimum number of years that a firm must have been in existence may be required by certain suppliers.

3. Industry Restrictions: Some Merchant cash advance blursoft companies may have restrictions on the sectors they may serve.

4. Personal Credit Check: Although Merchant cash advance blursoft generally concentrate on the company’s sales volume rather than personal credit scores, certain lenders may nonetheless do a mild credit check on the company owner or other important stakeholders.

5. Documentation: Businesses will often be required to provide particular financial records, including bank statements, credit card processing statements, tax filings, and other company identity papers.

6. Additional Considerations: Providers may also take into account additional elements, such as the business’s location, organizational structure, and the existence of any liens or judgments against it.

What are the Requirements to Get a Loan from Merchant Cash Advance Blursoft?

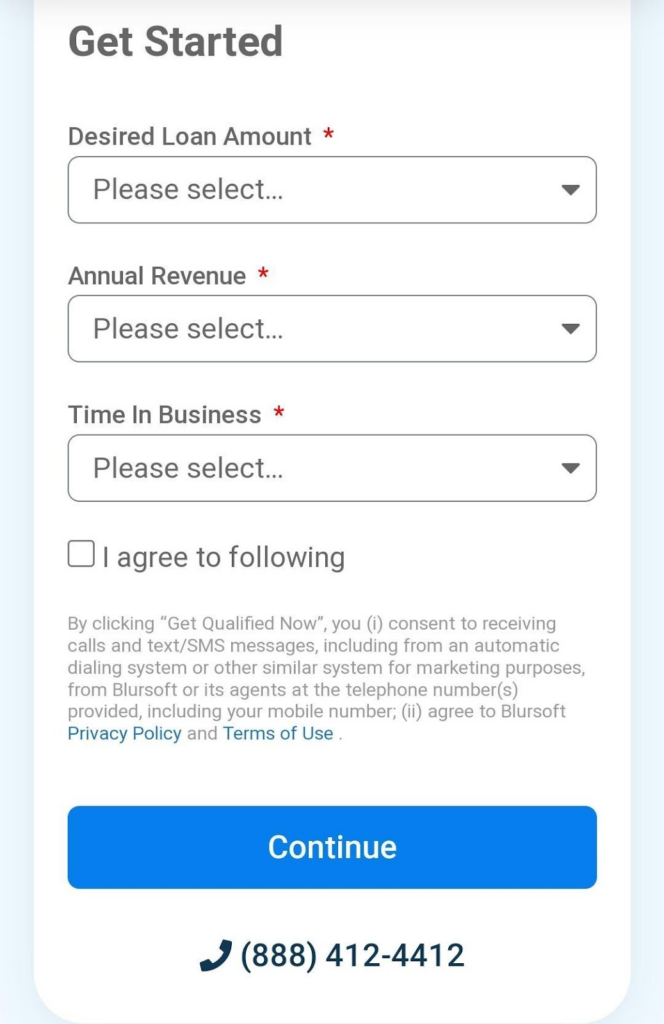

Image credit – blursoft

The following variables often influence the loan qualifying requirements for a Merchant cash advance blursoft:

1. Business Type: The majority of Merchant Cash advance blursoft companies work with a wide variety of companies, including retail stores, eateries, e-commerce organizations, and service providers.

2. Monthly sales Performance: Typically, companies applying for Merchant cash advance blursoft must meet a certain monthly revenue or credit card sales level.

3. Business Tenure: In order to qualify, certain suppliers may demand that firms have been in existence for a certain amount of time.

4. Personal Credit History: Although Merchant cash advance blursoft largely takes into account the company’s sales success, certain lenders may additionally check the personal credit histories of the company owner or other important stakeholders.

5. Adherence to Legal and Regulatory Standards: Companies applying for a Merchant cash advance blursoft must abide by all relevant legal and regulatory requirements.

How Merchant Cash Advance Blursoft Differ from Traditional Financing?

There are many key ways that Merchant cash advance blursoft differs from other forms of financing:

1. payback system: Unlike traditional loans, which require regular monthly payments, Merchant cash advance blursoft has a special payback system.

2. Eligibility requirements: When compared to conventional loans, Merchant cash advance blursoft often have more lenient eligibility requirements.

3. Funding Speed: Merchant cash advance blursoft is recognized for their quick approval and funding procedures. Applications are often processed quickly by providers, sometimes in only 24 hours.

4. Funds Usage: Compared to certain lending solutions, Merchant cash advance blursoft often provides more flexibility.

5. Cost Structure: In comparison to conventional loans, Merchant cash advance blursoft have a different cost structure. Merchant cash advance blursoft use a factor rate or a set fee structure as opposed to conventional interest rates.

Know Before You Borrow: Unveiling the Limitations of Merchant Cash Advance Blursoft!

There are certain restrictions on Merchant cash advance blursoft that firms should be aware of:

1. Price: Compared to regular loans, Merchant cash advance blursoft often have higher costs. A greater total payback amount may be caused by the factor rate or fixed fee levied by suppliers.

2. Repayment Structure: The adaptable repayment structure might be helpful, but it can also pose problems for companies with erratic sales volumes.

3. cash Flow Impact: Regular credit card sales deductions might have an impact on a company’s cash flow. It is critical to determine if the decreased cash flow would affect regular business operations and the capacity to pay for other essential costs.

4. Financial Restrictions: Merchant cash advance blursoft are often better suited for lesser financial requirements. It could be difficult to get enough cash with a Merchant cash advance blursoft if a company requires a higher sum of capital.

5. limits on Fund Usage: Despite the fact that Merchant cash advance blursoft allows for some freedom in how funds may be utilized, there may still be limits or limitations placed by suppliers.

6. Dependence on credit card sales: Companies that rely heavily on sales of credit cards are the main targets of Merchant cash advance blursoft.

Frequently asked questions

1. What is the payback schedule for a Merchant cash advance blursoft?

A Merchant cash advance blursoft requires payback based on a predetermined percentage of the company’s daily credit card sales or income until the advance is completely repaid.

2. How fast can I get cash using a Merchant cash advance blursoft?

A: Merchant cash advance blursoft are well renowned for their speedy processing; some suppliers may Accept applications in only 24 hours and distribute cash right away.

3. Are there any restrictions on how I may use the cash from a Merchant cash advance blursoft?

A: Without severe restrictions imposed by the supplier, Merchant cash advance blursoft enables freedom in cash utilization, enabling firms to deploy the funds for a variety of objectives, including inventory purchases, company development, and managing cash flow.

4. What elements decide my qualification for a Merchant cash advance blursoft?

A Merchant cash advance blursoft’s eligibility is often based on the company’s monthly sales volume, length of operation, industry classification, and observance of regulatory requirements.

5. How do Merchant cash advance blursoft fees compare to those of conventional loans?

A: Compared to regular loans, Merchant cash advance blursoft often have higher charges. They use a factor rate or fixed fee mechanism as opposed to conventional interest rates.

Conclusion

In conclusion, our investigation into Merchant cash advance blursoft review has shown a flexible and dynamic financing choice for companies. We have discovered the unique features and benefits that set Merchant cash advance blursoft apart from traditional loans via our interactive trip. This alternative finance option offers firms quick access to funds depending on their sales success, from the flexible repayment structure to the quick funding procedure. Businesses may make well-informed choices that fit their unique requirements and goals by carefully weighing these variables and comparing them to other financing options. Keep in mind the potential of Merchant cash advance blursoft to drive development and overcome financial obstacles as you negotiate the constantly shifting world of company finance.