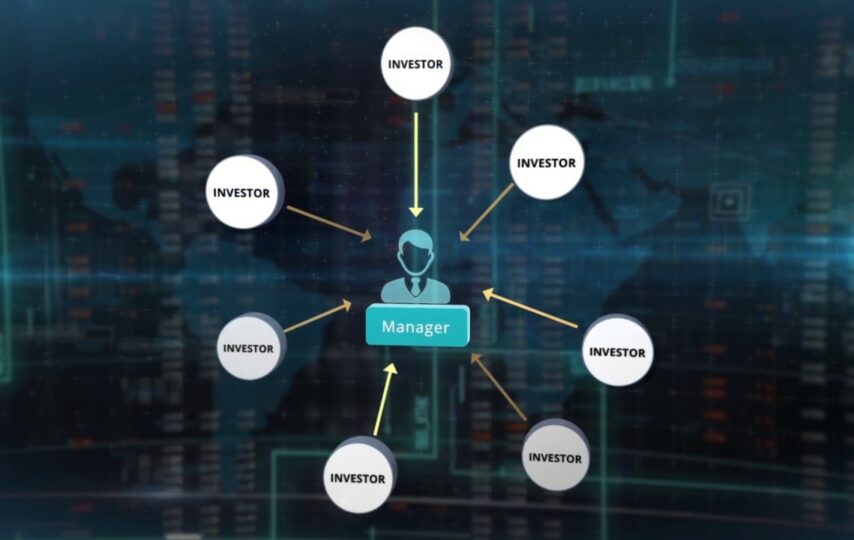

A Multi-Account Manager (MAM) is a software solution that allows forex brokers to manage multiple trading accounts from a single master account. With a MAM, brokers can allocate trades across multiple accounts and execute trades on behalf of their clients more efficiently.

With MAM solutions, brokers can manage multiple accounts with different trading volumes, leverage, and trading strategies. The solution allows the broker to create a master account where trades are executed and allocated to sub-accounts based on predefined allocation rules.

MAM solutions can work with all the platforms, from popular MT4 or MT5 to cTrader and any custom ones. Accordingly there are different types of MAM solutions: MT4 MAM, MT5 MAM, cTrader MAM and etc.

Forex brokers use MAM in several ways, including:

- Asset management: Forex brokers use MAM to manage assets on behalf of their clients, providing them with access to professional asset management services.

- Investment management: With MAM, brokers can offer investment management services to their clients, allowing them to manage their trading accounts and portfolios more effectively.

- Risk management: Forex brokers can use MAM to manage risk across multiple accounts, ensuring that the overall risk exposure is controlled and within acceptable limits.

- Trading automation: With MAM, brokers can automate trading across multiple accounts, executing trades based on predefined rules and strategies.

- Client reporting: MAM provides brokers with detailed reporting on trading activity across multiple accounts, enabling them to provide accurate and transparent reporting to their clients.

MAM’s benefits

In summary, MAMs can help forex brokers to increase trading volume by improving efficiency, scalability, and risk management, as well as offering enhanced investment and asset management services to their clients. By using MAM, brokers can better serve their clients, increase trading volume, and grow their business.

In particular:

- Improved efficiency: With MAM, forex brokers can manage multiple trading accounts from a single master account, which can significantly improve efficiency. Brokers can execute trades on behalf of multiple clients simultaneously, reducing the time and effort required to manage individual accounts separately.

- Scalability: MAMs enable forex brokers to scale their business by managing multiple accounts simultaneously. This can help brokers to expand their client base and increase trading volume without adding significant operational overhead.

- Automated trading: Many MAMs offer the ability to automate trading across multiple accounts, which can help brokers to execute trades more quickly and efficiently. Automated trading can also help brokers to manage risk more effectively, as trades can be executed based on predefined rules and strategies.

- Risk management: MAMs can help forex brokers to manage risk more effectively by providing them with tools to monitor and control risk exposure across multiple accounts. This can help brokers to reduce the risk of losses and improve overall trading performance.

- Enhanced client experience: MAMs can help forex brokers to provide a better client experience by offering investment and asset management services to their clients. Clients can benefit from professional investment management services, which can help to improve their overall trading performance and increase trading volume.

MAMs typically work

- Set up master account: The broker sets up a master account with a MAM provider, which serves as the primary account for managing client accounts.

- Add client accounts: The broker adds client accounts to the MAM system, which can be done manually or through an automated process.

- Allocate funds: The broker allocates funds to each client account based on the client’s individual investment amount and risk tolerance.

- Execute trades: The broker can execute trades on behalf of multiple clients simultaneously using the MAM system. Trades are executed on the master account and are automatically distributed to each client account based on the allocation set up by the broker.

- Monitor performance: The broker can monitor the performance of each client account in real-time using the MAM system. The system provides detailed reporting and analytics on the performance of each account, including profits, losses, and risk exposure.

- Manage risk: The broker can manage risk across all client accounts using the MAM system. The system provides tools for setting risk parameters and managing exposure to minimize losses.

The pitfalls

While multi-account managers offer many benefits to forex brokers, there are also several pitfalls that brokers should be aware of. Here are some of the key risks and challenges associated with using a MAM:

- Technical issues: MAMs are complex software solutions that require advanced technical expertise to implement and manage. If there are technical issues with the MAM, it can cause delays, errors, or other problems that can negatively impact client accounts.

- Increased risk: When managing multiple client accounts through a MAM, there is a risk that one or more accounts may experience losses that could impact the entire portfolio. It’s important for brokers to have a solid risk management strategy in place to minimize this risk.

- Complexity: MAMs can be complex and require a significant amount of training and experience to use effectively. This can be a barrier to entry for smaller or less experienced brokers who may not have the resources to invest in the necessary training and support.

- Costs: MAMs can be expensive to implement and maintain. The prices offered by popular solution providers like B2Broker or Takeprofit start from $700 per month. This can be a significant cost for forex brokers with smaller client bases and startups.

The pricing can vary depending on a range of factors, including the broker’s specific needs and the number of accounts being managed. For example, a MAM with advanced risk management tools may cost more than a basic MAM with limited features.

As well as, generally, the more accounts being managed, the higher the cost of the MAM.

The cost of integrating a MAM with the broker’s trading platform can also impact the overall pricing. If the MAM requires custom development or other specialized integration, this can add to the cost.

Together with this some MAM providers may offer customized solutions for specific broker needs, such as white-labeling or customized reporting. These customized solutions may come with an additional cost. - Compliance issues: When managing multiple client accounts through a MAM, brokers must comply with a range of regulatory requirements, including those related to risk management, reporting, and transparency. Failure to comply with these requirements can result in legal and financial penalties.

Conclusion

In conclusion, the MAM solution is a powerful tool for forex brokers, allowing them to manage multiple accounts more efficiently, automate trading, and provide investment and asset management services to their clients. By using this tool, brokers can increase efficiency, reduce risk, and enhance their clients’ trading experience.