This blog post focuses on strategies for creating a diversified crypto portfolio using a portfolio management system and revolves around the idea of making investment more simplified and automated. It concerns points such as asset allocation, risk management techniques, rebalancing strategies, and incorporating different cryptocurrencies and tokens into the portfolio.

Performing each one of the tasks mentioned above manually is prone to multiple human errors which is why suitable alternatives have been introduced and put to use. All the tasks mentioned in the above paragraph can be performed with accuracy and precision when you use a crypto portfolio management system.

What is a Managing System in terms of Crypto Portfolio?

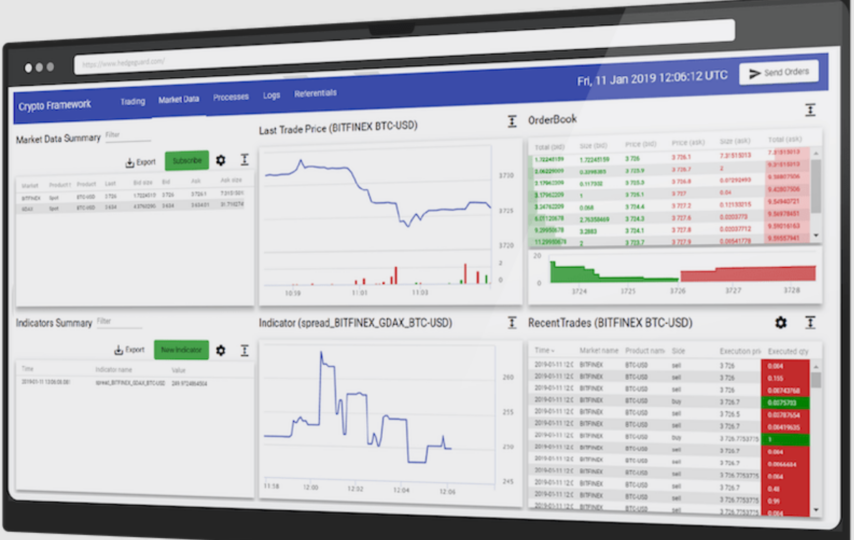

As mentioned above a crypto PMS is capable of handling your crypto portfolio with ease thereby making informed investment related decisions and facilitating automated actions that are targeted at providing better and promising results on your investments. It uses an algorithmic approach in its operations to make well informed and assessed investment decisions.

It is a platform designed to serve a specific cause which is to assist crypto investors(especially institutional investors) in making fortune by helping them yield higher returns on their investments with the help of better strategies.

Why do institutional investors need a Crypto Management System to begin with?

In order to understand why institutional investors need a Crypto PMS we better attempt an understanding of the introduction of the market as well as its transformation. Cryptocurrencies came into being with the launch of Bitcoin in 2009. Bitcoin is the first ever Cryptocurrency to be launched. Its popularity over the course of time had further paved the way for hundreds of cryptos that came into existence following the launch of Bitcoin.

Because there are a huge number of cryptocurrencies present in the market today, the crypto market has become more and more complex over the years. Plus add to this the fact that it is highly volatile. It is because of these two core reasons that institutional investors need a crypto PMS to efficiently track and manage their portfolios.

Important strategies to diversify a Crypto Portfolio with Management systems

- Risk Assessment: By attempting an analysis of the historical price data and using various risk assessment metrics, a crypto PMS can assess the risk concerning different cryptocurrencies. This information thus proves useful and comes in handy in determining the risk profile of your portfolio thereby making informed decisions about rebalancing.

- Diversification: A well-designed and well operated crypto PMS can suggest optimal asset allocations based on how much risk you can tolerate, your investment goals, and the market conditions certainly. It helps ensure that your portfolio is diversified across different cryptocurrencies thereby reducing exposure to individual coin risks.

- Rebalancing Recommendations: With fluctuating market conditions and asset prices, your portfolio’s initial allocation may as well drift over time. At times like these a crypto PMS provides rebalancing recommendations, alerting you of significant deviations in your portfolio.

There are a number of PMS’s available out there, Binocs is one such PMS yet different in all possible ways. Binocs provides its users with exclusive features such as performance tracking and reporting, over the clock risk analysis, asset allocation and reallocations among others. It is one of the most preferred PMS by institutional investors and thus can be deemed as the best PMS in the market.