As inflation continues to increase, a significant percentage of the US population – 64% – finds themselves living paycheck to paycheck. It also leaves them financially vulnerable to unforeseen emergencies or expenses. Such situations can significantly affect an individual or their family.

During these times, Credit Clock loans and Bad Credit Loans have proven to be helpful options. These easily accessible loans, including payday or tribal loans, can come in handy. This is particularly true for those with poor credit history, low income, or no employment status. For them, it can also provide immediate financial assistance. Read the article about tribal loans direct lender guaranteed approval 2023.

Tribal Loans Direct Lender Guaranteed Approval

1. Credit Clock:

Our top recommendation for an alternative to traditional tribal loans is Credit Clock. With lending rates ranging from 5.99% to 35.99%, this option also offers guaranteed loans ranging from $100 to $5000. Note that the repayment periods span from 2 to 24 months.

Credit Clock stands out as an excellent option for several reasons. Some of them include: no credit checks, easy application, quick payout, fast approval, minimal interest rates, and flexible loan amounts. Additionally, it is a convenient choice as most individuals qualify for its loans. And those with bad credit can also access a wide variety of loan options tailored to their needs.

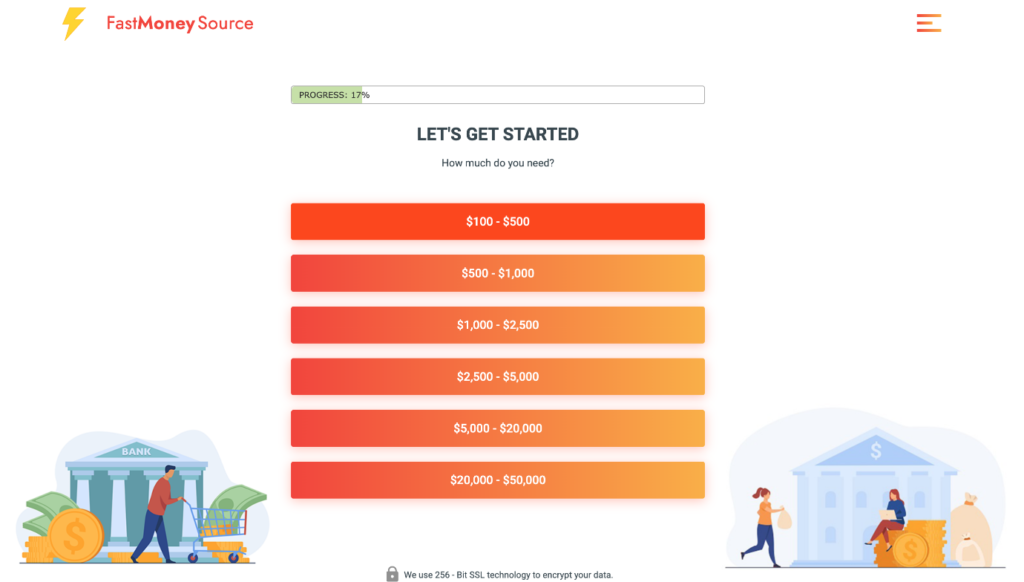

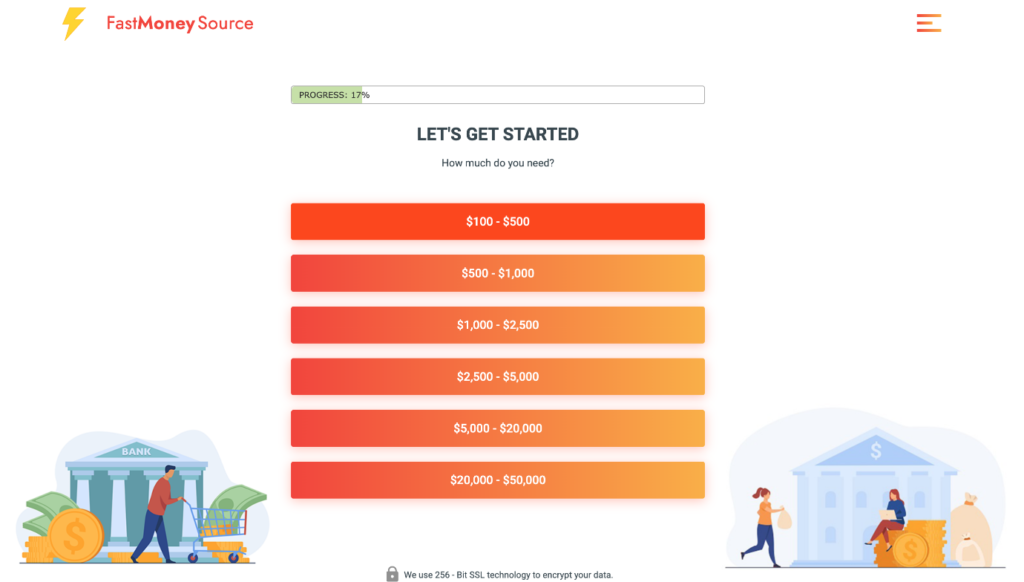

2. Fast Money Source:

If you’re in search of a regulated lender approved by the Online Lenders Alliance (OLA) to provide quick access to funds, look no further than Fast Money Source. This lender also offers borrowers a vast array of options, with a borrowing limit of up to $50,000 per client.

They also facilitate fast transfers to your bank account at no additional cost. Some of the primary benefits of using Fast Money Source include no waiting in line, no need to visit a physical store, low fees and interest rates, secure transactions, regulated services, fast approvals, and quick payouts.

In summary, Fast Money Source is a user-friendly loan intermediary. It connects borrowers with the best available lenders on their network. The service offers competitive rates and maintains transparency throughout the lending process. All this makes it a trustworthy option for those seeking quick funds.

3. Fast Loans:

Fast Loans is an ideal lending platform for those in need of loan amounts ranging from $200 to $50,000. This service has a broad network of third-party lenders who can provide such amounts. And all from the comfort of your home.

Fast Loans stands out as a top choice for several reasons. The reasons include fast disbursement of funds, ease of use, convenience, instant approval, and secure transactions. It is particularly noteworthy for individuals seeking larger loan amounts. This is because the platform offers a user-friendly experience with quick approval even for significant sums.

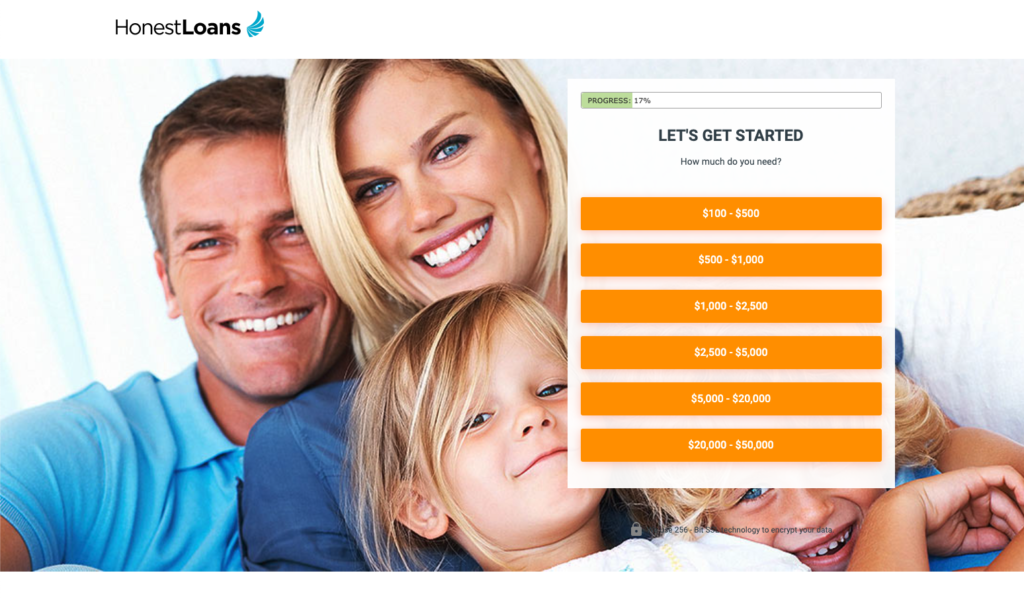

4. Honest Loans:

Honest Loans is an excellent lending platform that offers a straightforward online application process. It also offers additional options for credit repair or debt relief services in the event of loan denial from traditional financial institutions.

service stands out as a top choice for several reasons, including ease of application, quick funding, fast loan approval, and access to a broad range of loan options. Honest Loans is committed to connecting borrowers with their preferred lenders to provide payday loans at competitive rates and with maximum convenience.

5. Big Buck Loans:

For individuals in urgent need of funds, Big Bucks Loans is an excellent option offering loans ranging from $100 to $5000 with relatively low-interest rates of 5.99% to 35.99%. The platform provides extended repayment periods of 3 to 24 months, ensuring that borrowers have ample time to repay their loans.

Here are some of the top reasons why Big Bucks Loans stands out as a top choice for borrowers in need: No hidden costs. Competitive interest rates. Positive reputation. Fast disbursement of funds. Flexible loan amounts and policies. Easy application process.

One of the key differentiators of Big Bucks Loans is their incredibly fast loan disbursement and approval times, typically taking only 15 to 20 minutes. This quick turnaround time means that borrowers can access funds promptly without having to endure long waiting periods for loan approvals.

Apply for Tribal Loans Direct Lender Guaranteed Approval

The process of applying for a payday or tribal loan is typically straightforward and hassle-free, thanks to the online nature of the service.

Select a lender from the recommended list.

Give the necessary details.

Wait for the system to review and process your application.

Receive notification of loan approval.

Once approved, the loan amount is disbursed to your bank account, typically within a few business days.

Regardless of your experience with borrowing or using online lending platforms, you can count on a user-friendly interface that makes the application process straightforward and stress-free. Furthermore, you can expect speedy responses, eliminating the need for prolonged waiting times.

What is a Payday Loan?

Payday loans are designed to provide borrowers with quick access to cash for urgent needs or emergencies that may arise before their next payday. The loan application process is usually straightforward, and approvals can be fast without stringent credit checks like traditional loans.

Payday loans are known for their flexibility, as borrowers can negotiate with lenders on various loan policies, including repayment terms, penalties, and loan amounts. It’s important to note that borrowers have the freedom to decline any terms that they are not comfortable with.

It is important to keep in mind that payday loans generally come with higher interest rates due to the inherent risks involved, such as bad credit and low credit scores. However, we have carefully selected some of the most affordable lenders in the market for your convenience.

Who is Eligible for Payday Loans?

To become eligible for tribal loans with direct lender guaranteed approval , there are some basic requirements that you need to fulfil. These include being a US citizen or a permanent resident, being at least 18 years old, having a valid source of income that can be verified, possessing a bank account, and having an active email address or phone number.

Meeting these requirements is relatively easy for most people, which is why the approval rate is typically very high, close to 100%.

Also Visit: 5G Changing the Game for Online Casino Industry