Not all types of business ownership are the same. Here’s what you should know.

Did you know the name on the business or title may not be the company owner?

There are different types of business ownership.

You can be a registered or beneficial owner and each one has specific benefits.

So what is the difference between the two types of ownership?

We’ll take a look at both so you can get a better understanding.

Who knows, maybe you will want to become the ultimate beneficial owner of multiple businesses.

Understanding the Different Types of Business Ownership

A registered business owner is listed on the business title.

They also hold company shares under their given name.

You can look at the business records and know who is listed as the owner and the number of shares they control.

All of the information is out in the open.

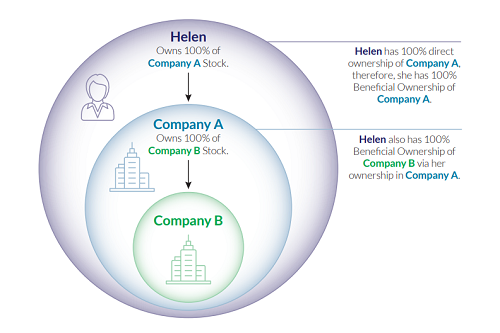

A beneficial owner is a little different.

They are not listed as a business owner and typically hold company shares through an investment broker or bank.

The ultimate beneficial owner typically owns around 25% or more of the company.

It may surprise you to learn this is how a majority of investors own their stocks.

When searching for information about these shareholders, you typically only see the bank or broker listed on the documents.

Benefits and Disadvantages

Beneficial business ownership has its advantages and a few downsides.

Stockholders can control their company shares and receive dividends without divulging their names.

In some instances, the practice can simplify the process of buying certain investments like securities.

The broker or bank handles the paperwork, allowing the private investor to remain almost anonymous.

It can also make it easier to manage larger investment portfolios.

However, there can also be downsides to allowing your investments to remain in a bank’s or broker’s name.

When you own securities through a beneficial arrangement, dividends are paid to the bank or broker.

Typically, the financial institution or brokerage firm receives a fee for its services from your dividends.

If you want to sell the securities, it must be done by the bank or broker.

While regulations are in place to prevent it from occurring, shell companies can use this form of investing to hide illegal practices.

Legal Requirements

There are strict legal requirements for brokers, financial institutions, and investors.

The laws are in place to prevent the formation of shell companies and/or individuals from investing their dividends in terroristic and other illegal/dangerous activities.

The investor’s legal name must be recorded as the owner of the assets. It does not become public information, instead, the owner’s name is held by the bank or broker.

Is Silent Investing Right for You

Beneficial or silent investing is a common practice for individuals dealing with large investment portfolios. It can simply the management of their securities and also provides a level of privacy.

However, it is vital that you only work with a reputable broker, firm, or financial institution. Remember, your dividends are sent to the investor on record and not directly to you.