In the world of forex trading, two names reign supreme: MetaTrader 4 and MetaTrader 5. Millions of traders across the world use these platforms for trading despite their experience level. However, most of them don’t know that MetaTrader 5 is not an upgraded version of MetaTrader 4. In fact, these two are entirely different platforms. These names might resemble, but there are a lot of differences that set these two platforms apart.

Let’s talk about them in this article MT4 v/s MT5!

Programming Language

Trading platforms MT4 and MT5 each employ a unique proprietary programming language, MQL4 and MQL5, respectively. Both of them are high-level object-oriented languages with MQL5 specifically built on C++. Despite the fact that both languages are quite similar to C++, MQL5 allows for “black box” programming, which makes it simpler to write and is perfect for users and creators of trading robots and other expert advisers. MQL5 is also considered as a more advanced programming language as it offers the ability to build or modify scripts. However, MQL4 is meant for novice or amateur traders who desire a platform that can be rapidly installed and deployed with minimal procedures. This helps MQL4 maintain its popularity in the industry. It is also believed that there will be no updates in MQL4, contrary to MQL5, where continuous variations keep happening. This can be advantageous for novices as it reduces hurdles for them in getting started with MT4, but advanced traders may prefer MQL5 as they keep looking for updates.

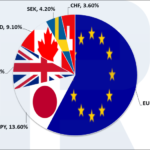

Markets

MT4 is predominantly used for trading CFD forex instruments, while MT5 is a comprehensive multi-asset trading platform compatible with centralised and non-centralized financial markets. It was designed to allow traders to access markets beyond Forex, including futures, equities, bonds, and options. If you look closely at these markets, you will realise that Forex is a decentralised market with several major players offering liquidity at different prices. At the same time, stocks and commodities must be traded through a centralised exchange. That demonstrates the fact that MetaTrader 5 was developed to support a broad range of markets in order to expand the retail market for stocks, and commodities besides the currency market. That being said, MT4 and MT5 provide traders with enough tools and resources to trade in these markets.

Timeframes

MT4 offers only 9 timeframes, sufficient for swing and long-term traders. In contrast, MT5 offers 21 timeframes, giving traders the benefit of a more in-depth study of their preferred assets. For MetaTrader 5, additional timeframes M2, M3, M4, M6, M10, M12, M20, H2, H3, H6, H8, and H12 are available. These timeframes enable traders to examine trading using charts for given time frames, such as two, six, eight, or twelve hours. Traders that need a more in-depth market analysis may benefit from MT5’s greater range of timeframes.

Technical Indicators

Since MT4 and MT5 are quite effective for technical analysis, MT5 provides a slightly wider range of built-in technical indicators than MT4. MT4 provides traders with 30 technical indicators, while MT5 offers 38. Moreover, MT5 provides more drawing tools than MT4, including Fibonacci studies and Elliot wave sketching tools. Moreover, MT5 has 44 graphical elements as opposed to MT4’s 31. Both platforms let users download their own custom indicators from their respective code bases or markets; MT4 offers over 2000 such downloads, while MT5 offers a comparable selection of free and paid alternatives.

Graphical Objects

MT5 has a wider variety of drawing tools and graphical objects than its forerunner, MT4. While MT4 has 31 graphical objects, MT5 offers 44, including geometric shapes, channels, Gann, Fibonacci, Elliott wave tools, and more. In order to conduct a more thorough examination of the market, these tools assist traders in marking patterns, regions, and levels on the chart. Moreover, MT5 offers tools for drawing out Elliott waves and performing extra Fibonacci analyses, all of which can be very helpful to technical traders.

Pending Order Types

Pending orders are requests made by traders to purchase or sell a security at a certain price in the future. These orders support traders in developing their trading plans and reducing risk exposure. With the addition of Buy Stop-Limit/Buy Limit and Sell-Limit/Sell-Stop Limit orders, MT5 now offers six types of pending orders, compared to MT4’s four (Buy Limit, Buy Stop, Sell Stop, and Sell Limit). Due to the ability to specify a stop and a limit level for their pending orders, these additional orders help traders manage their positions more effectively. By employing these pending orders, traders can automate their trades and profit from market fluctuations even when they aren’t actively watching the markets. However, it should be noted that MT5 provides traders more flexibility and control over their pending orders than MT4, making it a better choice for traders who want to fine-tune their trading strategies.

Order Fill Policy

Both MT4 and MT5 have four options for order fill policies: “Fill or Kill,” “Immediate or Cancel,” “Return,” and “Partially Filled.” If the order is marked “Fill or Kill,” it must be completed in its entirety; if it is marked “Immediate or Cancel,” it must be completed right away. If no quotes are available, “return” indicates that the order won’t be filled. An order can be partially filled using the “Partially Filled” option, and the remaining portions can be filled at a later time. However, MT5 adds two more options, “Fill or Kill – Market” and “Fill or Kill – Limit,” that MT4 does not, giving it more flexibility for partial fills.

Economic Calendar

The Economic Calendar in MT5 is a substantial advancement over MT4, offering a seamless and all-inclusive tool for monitoring macroeconomic developments. It is a useful tool for traders who want to remain on top of the most recent financial news and events that could impact the markets. Using up-to-the-minute information, the calendar can aid traders in trade planning, risk management, and decision-making. So that traders can better prepare themselves for future market volatility, the MT5 Economic Calendar also shows the anticipated impact of impending news releases.

Depth of Market

Depth of Market (DOM), a potent feature of MT5, gives traders access to real-time data on the order book and market liquidity. The DOM function gives traders a deeper knowledge of the market sentiment and anticipated price fluctuations by showing the quantity of buy and sell orders at various price levels. This information is critical for making informed trading decisions, especially in highly volatile markets. Trades can be executed more accurately if traders understand the market’s depth and liquidity better by looking at the bids and offers priced across markets. The DOM feature is a crucial tool for traders who want to keep on top of the market and make good trading decisions.

Netting

Several trades of the same financial instrument are combined into a single position using MT5’s netting trading approach. Lowering the amount of margin needed and streamlining their trading process enables traders to manage their positions more effectively. The netting system, for instance, will aggregate all of a trader’s positions into a single netted position if the trader repeatedly buys and sells a particular currency pair. This might be especially helpful for traders who prefer to trade frequently and concentrate on just one financial instrument.

Embedded MQL5 Chat

A built-in MQL5 chat function in MT5 enables users to interact with other users or professionals right from the platform. The chat feature can be used to exchange ideas, discuss trading tactics, and obtain immediate responses. New traders who require direction and support in their trading experience may find this feature to be especially helpful. Traders can connect with traders worldwide through the MQL5 chat and learn from their experience. Also, the chat component aids in creating a community of traders who can share knowledge and develop their trading abilities together.

Strategy Tester

A sophisticated Strategy Tester is available in MT5 but not in MT4. The Strategy Tester enables traders to evaluate the effectiveness of their trading strategies by backtesting them using historical data. In order to evaluate how their strategies might perform under various market scenarios, traders can simulate various market conditions. With the aid of this tool, traders can better their trading results by refining their strategies and making data-driven decisions. Using Strategy Tester, traders may evaluate their trading system’s stability, pinpoint their approach’s advantages and disadvantages, and make the required adjustments. By doing this, traders can enhance their trading efficiency and base their choices on facts.

Understanding MetaTrader 4 and MetaTrader 5 platforms is crucial to understanding which platforms suit your trading needs best and will ultimately improve your trading experience.