Increased competition, price factor, or simply not being interested anymore – these are some of the reasons why your customers may not remain your customers anymore.

Of course, losing customers can be an unfortunate case for a business, but that’s how it works. No customer sticks around forever; even your most loyal customers may abandon you at some point – this is a reality every business must understand.

This is why every business must keep an eye on its churn rate. Wondering what it is and how it affects your business? We have got you covered. This article contains an in-depth guide on churn rate, ways to calculate it, and other details. Read ahead to know more!

What is Churn?

The number of customers who stop using the services of a business during a particular time period is referred to as “churn”. It happens to be an important SaaS metric.

Basically, your monthly churn rate is the percentage of customers you have lost over one month. As established earlier, losing customers is inevitable. However, it is important to note that even a minor increase in churn rate can impact a business adversely in the long run.

Particularly for small businesses struggling to firm their feet in the competitive market, an increase in churn rate can prove to be fatal.

While churn cannot be avoided totally, you should, however, pull all stops to ensure the churn rate is on the lower side. But before that, you should know how to calculate it. And this is what we have covered in the following section.

Ways to Calculate Churn Rate

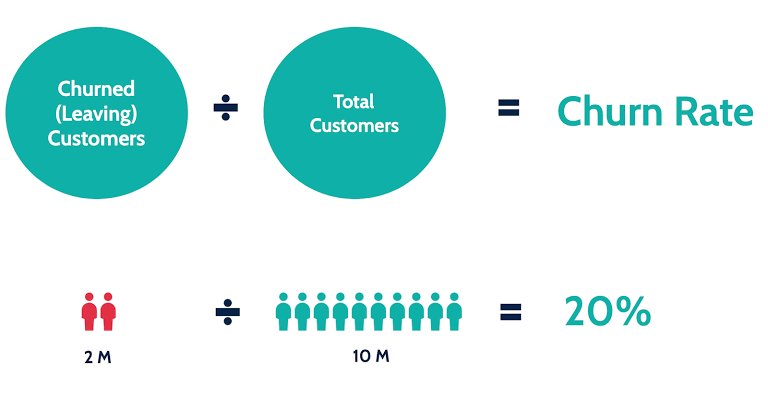

Organizations follow a variety of ways to calculate churn rate. Among the most straightforward of doing it is by dividing the number of lost customers by the number of total customers during a particular time period. Then, multiply the obtained figure by 100. It will provide you with a churn rate in the form of a percentage.

To put it simply, here’s the formula for churn rate:

(Lost customers in the last quarter + Active customers in the last quarter) x 100

Revenue Churn Rate

Apart from customer churn rate, companies can also calculate revenue churn rate. As the name suggests, it measures churn based on revenue lost instead of revenue lost.

Coming to the formula for calculating the revenue churn rate, it’s actually the same as the aforementioned, with the exception being you’d be using revenue data instead of customers.

Many companies calculate revenue churn rate as it provides them with a clear picture of their business’s financial health. For example, when you calculate the customer churn rate, it doesn’t specify how many premium or standard customers you have lost.

More About Churn Rate

After how long should I calculate my company’s churn rate?

While calculating the churn rate will provide you with insightful data, doing it over and over again after short intervals won’t help. Ideally, you should calculate after a longer time period if you want substantial data to work on.

For instance, calculating it on a quarterly basis can assist companies in knowing about customer trends. On the contrary, doing it annually will help you assess your yearly performance pertaining to revenue and customer retention in a better way.

But if you want to know about your company’s churn rate on a regular basis, Baremetrics is your partner. This tool can help you get insightful data in a simple, time-effective manner. It provides you with a dashboard where you can see your churn rate along with other SaaS metrics.

What is an Acceptable Churn Rate?

There’s no globally acceptable or good churn rate. You may come across some exceptional churn rates shared by some founders on LinkedIn. Take them with a grain of salt since some founders do exaggerate when it comes to sharing their “success” stories. No surprise here!

Also, if you run a startup, these numbers do not concern you since startups tend to have higher churn rate.

Do Churn Rate Impact Other SaaS Metrics?

Yes, it does. In fact, your churn rate ties in with other SaaS metrics related to revenue.

For example, it goes without saying that the higher the churn rate, the more adversely it impacts your revenue.

What is the Importance of Churn Rate for a Business?

Do you know that acquiring a new customer can cost you 5x or 6x more than retaining an existing customer? Now, by keeping your churn rate on the lower side, you’re actually helping your business to reduce cost as the customer retention rate is on the higher side.

This clearly explains the importance of maintaining a lower churn rate.

To illustrate further, if you’re keeping a tab on your churn rate using Baremetrics’ dashboard, you’d know when a customer has churned. This can be taken as a signal that something has gone wrong.

Of course, losing a customer can be due to many reasons. Some of them may be out of your control. But, generally, knowing why they have left can help you make things better. You can get a cue on numerous actionable items, such as:

- Improving your service standards

- Offering add-ons

- Increasing customer satisfaction

- Improving customer support

Besides the aforementioned, keeping a tab on churn rate can also help you to tackle competition. For example, a major reason for customers abandoning a company is due to the rise in competition. So, taking into account churn can help you monitor the activity of competitors and plan your strategy going forward effectively.

It can also help to improve your pricing strategy. You can extend discounts or offer new ones in order to retain customers.

How to Know Why I Lose Customers?

All these practices to retain customers and decrease churn rate will only help you if you know why your customers are churning in the first place. Obviously, when you don’t know the reason, you won’t be able to retain them.

There are certain practices you can follow in order to know the reasons. However, the most effective one is using Baremetrics. It comes with a cancellation insights feature that converts reasons for churn into insightful data points. Basically, it highlights the common reasons for churn.

Once you have known those reasons, it’s up to you how you cater to them.

Wrapping Up

To sum it up, knowing about your churn rate can benefit you in more than one way. And using a handy tool, such as Baremetrics, is the best way to go about it.