UKBadCreditLoans is an online lending service that is dedicated to pairing borrowers with online third-party lenders. As such, they are not to be confused with a direct lender, as they do not finance loans. Instead, they simplify the lending process by ensuring that borrowers do not have to fill out several different applications from one lender to the next.

The lenders in their lending network are also open to accepting loan applications from borrowers with a less-than-stellar credit rating. This means that you can get some of the best loans for bad credit from UKBadCreditLoans, but keep in mind that the tradeoff is usually having to deal with higher interest rates.

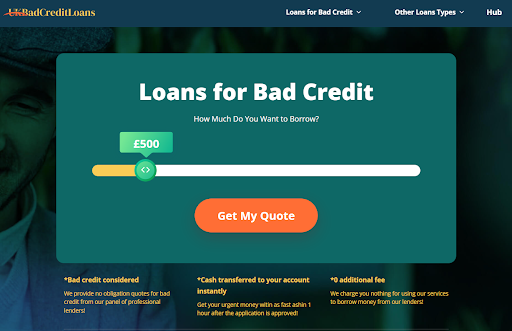

The service is also free to use, and when it comes to borrowing, users can typically access loans ranging from £100 to £5,000. And while loan terms and conditions will often vary depending on your credit status and the lender, you can usually expect the repayment period to run between 1-36 months.

What Is The Loan Request Procedure at UKBadCreditLoans?

The good thing about submitting a loan request via UKBadCreditLoans is that it is a straightforward process. However, before you get started, you first have to make sure that you meet the basic eligibility requirements needed to submit a request on the site. This means making sure that you:

- Are at least 18 years old

- Are a UK citizen or permanent resident

- Have an active checking account under your name

- Have a stable source of income, eg. a job or business

If you meet all these conditions, you can take out quick loans by visiting this page, but you should also make sure to have all your personal financial information in hand. This includes details like your bank account number, credit score, income level, etc. When you’re ready, you can get started by filling out the online form on the site.

This should only take a few minutes to complete, and once you’ve submitted it, your loan request will be reviewed, and if approved, you will be connected with multiple lenders, each with their own offers. You will need to review and compare them until you find the one that provides you with the best rates and terms.

If you decide to accept an offer, you will only have to e-sign the loan agreement, and the lender will begin to process your funds. Most of the time, you can expect the funds to reflect in your account as soon as the next business day.

UKBadCreditLoans – Notable Features

UKBadCreditLoans is known for accommodating first-time borrowers and taking them through the online lending process with ease. It also doesn’t have any complex application requirements, nor do you need to submit any lengthy paperwork, either.

The site also makes it easy to compare your loan options by presenting you with a transparent view of all the interest rates and terms offered to you by their lending network. This makes it easy for you to find the best possible deal that best fits your budget and financial needs.

It also ensures that you don’t end up taking on a loan that you cannot afford to repay, thereby reducing the risk of you falling into bad debt.

The platform is also dedicated to ensuring that its users’ data remains confidential and protected, which is why it utilizes high-end data encryption software. In addition, they also have a strict privacy policy in place that ensures your information is not shared with any unauthorized third parties.

On top of that, the service only partners with FCA-compliant lenders, which means that they are all legitimate and regulated by the government. As a result, there is zero risk of falling victim to any predatory lending practices. This makes them an ideal solution for those seeking out an online loan provider but who aren’t confident in their ability to identify trustworthy lenders from fraudulent ones.

However, the main selling point of UKBadCreditLoans is that using the service does not require you to pay anything at all. It is completely free to use with no hidden costs or fees to worry about, and you don’t even need to sign up for an account or membership, either. This means that you can always feel free to explore what loan offers are available to you at any time.

Is UKBadCreditLoans Legit?

From what we’ve seen, UKBadCreditLoans is a completely legitimate online credit service. It has a long line of positive testimonials from past borrowers, and it has also been in the industry for a few years now.

When you also consider that it only partners with FCA-compliant lenders and makes an active effort to guarantee complete data security, this makes it a trustworthy loan service that you can depend on.

Does Using UKBadCreditLoans Impact Your Credit Score?

The good thing about submitting a loan request via UKBadCreditLoans is that their lending network will only conduct soft credit checks on your application. As a result, there is no chance that your credit score will dip just by exploring your loan options on the site.

However, it is important to keep in mind that all lenders in the UK are compelled by the Financial Conduct Authority to conduct a credit check before approving any loans. As such, if you chose to accept a loan offer, there is a high chance that the lender you choose will carry out a hard credit check on your report.

Is UKBadCreditLoans Right for You?

UKBadCreditLoans comes with pros and cons that you should always consider before you decide to submit a loan request. In this regard, some of the main benefits of using UKBadCreditLoans include the following:

#1. No minimum credit score required: UKBadCreditLoans’ lenders do not require you to have a good credit score to qualify for a loan. This is because they will usually look at other factors, such as your income level and employment status, when evaluating your loan application.

#2. Free loan service: As mentioned before, you don’t have to pay any fees to submit a loan request through the UKBadCreditLoans system. This means that you don’t have to worry about making any financial commitments or paying numerous application fees to different lenders.

#3. Instant Loan Comparison: UKBadCreditLoans makes it easy to instantly compare multiple loan offers with minimal effort, which spares you a lot of time and effort in having to look for the lenders yourself. This also guarantees that you are able to secure yourself the most competitive rate possible.

#4. Extensive Loan Network: The lending service is partnered with dozens of online lenders, many of whom are able to offer borrowers access to a wide variety of loan products. Some of these include payday loans, same-day loans, quick loans, bad credit loans, and more. As a result, it is very easy to find a loan that suits your needs perfectly.

On the flip side, UKBadCreditLoans isn’t without drawbacks. Some of the negative aspects of using this platform include;

#1. High-interest rates: You can usually expect to end up paying a higher interest rate when borrowing from the UKBadCreditLoans network, with some rates going as high as 49.7%. However, keep in mind that your rate can often vary depending on how high or low your credit score is.

#2. No direct loans: UKBadCreditLoans only connects borrowers to lenders, which means that it has no influence over the rates and terms imposed by its lending network. In other words, if you have any issues with your loan, you will need to deal directly with the lender, as UKBadCreditLoans will be unable to help you.

UKBadCreditLoans Review – Wrapping Up

This platform is a great resource that you can use if you need to access quick funding, even with a poor credit rating. And with dozens of lenders to choose from, it is very easy for you to get a loan offer and the specific type of loan that is best suited to your financial situation. Just be sure to only sign a loan agreement if you are confident that you can afford to make the repayments on time.